Triangular arbitrage in cryptocurrencies is a trading method that takes advantage of the opportunity to take advantage of price differences in the same cryptocurrency or different currencies on one or more exchanges. This method involves three trades that consist of buying and selling cryptocurrencies in an effort to profit from temporary anomalies in their value. It is one of the sophisticated trading strategies used in the cryptocurrency market to profit from momentary differences in the prices of currencies on different exchanges or within the same exchange but in different currency pairs. This strategy requires the simultaneous participation of three currencies and the creation of three consecutive trades, which makes it particularly interesting for arbitrageurs looking to optimise their operations and minimise risk.

An introduction to the mechanics of triangular arbitrage

Definition of triangular arbitrage

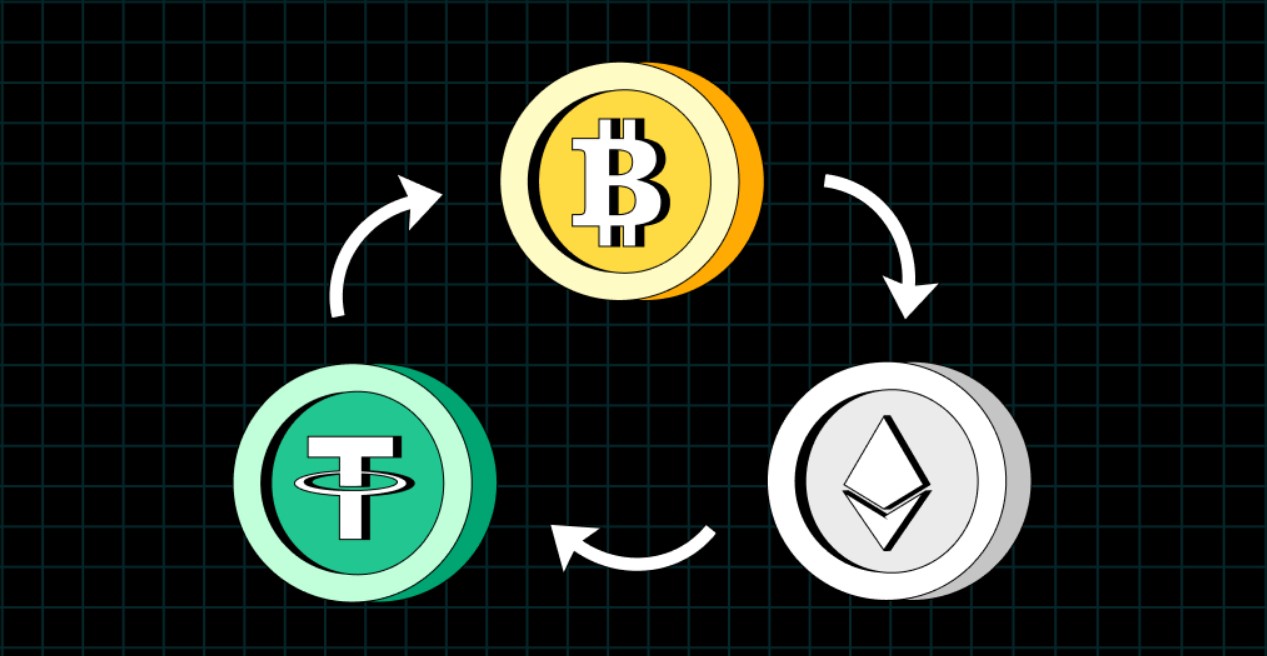

Triangle arbitrage involves three trades that are locked in a loop, allowing the trader to return to the original currency at a profit. The process begins by analysing the currency pairs available on the selected cryptocurrency exchange, or between multiple exchanges, to identify a potential arbitrage opportunity.

Example of a triangular arbitration scheme

Let's imagine that we have the following currency pairs on different exchanges or in different price corridors on the same exchange:

BTC/USD

BTC/ETH

ETH/USD

A trader starts with a certain amount in USD. The first step is to buy Bitcoin (BTC) for US dollars. Then, the trader exchanges his BTC for Ethereum (ETH) if the price of ETH relative to BTC is favourable. The last step is to sell ETH for USD. If after completing all three transactions, the total amount of USD is greater than the initial amount, the arbitrage is considered successful.

Basic steps to perform triangular arbitrage

Identification of opportunities

A trader must regularly monitor and analyse the exchange rates of currency pairs on different exchanges or within one exchange. There are specialised programs and bots that help in automating this process by providing real price data and helping to calculate potential profits from arbitrage operations.

Calculations and planning

Accurate calculations are the key to successful triangular arbitrage. A trader must take into account all possible transaction fees on exchanges, as well as potential price sliding during order execution. These factors can significantly affect the final profit.

Fast execution of transactions

In the field of cryptocurrencies, speed is a critical factor as prices can change in seconds. Once all calculations have been made and the scheme has been confirmed as potentially profitable, the trader must execute all three transactions quickly to minimise the risk of changing market conditions that could negatively impact the arbitrage outcome.

Advantages and risks of triangular arbitrage

Advantages

Isolation from market risk: Triangular arbitrage, if executed correctly and quickly, avoids prolonged exposure to market volatility because transactions are closed in a short time.

Potential for automation: Many aspects of arbitration can be automated using software, increasing efficiency and reducing human error.

Risks

Market Volatility: Despite fast transactions, instantaneous price changes can lead to unexpected losses.

Technical failures: Failures of trading platforms or delays in processing transactions can significantly affect the success of arbitration.

Triangle arbitrage is a complex but potentially profitable strategy in the cryptocurrency market. It requires in-depth knowledge of market mechanisms, the ability to quickly analyse and make decisions, and access to appropriate technological and software resources. Careful planning, ongoing education and adapting to changing market conditions can help traders maximise their success in using this strategy to profit.